The market in flux

We are just halfway through what has already been a significant year for the voluntary carbon markets (VCM). Change is visible everywhere: new climate disclosure regulations are coming online around the world, further guidance is being developed and issued by market bodies like the IC-VCM and VCMI, and the market has received an unprecedented amount of mainstream media attention.

These changes have caused movement and confusion in the market, leaving many would-be buyers hesitant to get involved. But the need for carbon project funding has never been more critical. Sylvera’s recent Carbon Markets Summit brought together carbon market leaders from around the world to discuss the current state of and future possibilities for the carbon market. This expert guide, produced by Sylvera and Pachama, reflects on the top ten trends these carbon market experts see in 2023 and beyond.

Hear from carbon experts on what they’re seeing today and predicting for tomorrow.

10 trends to watch

- Small setbacks have occurred against the backdrop of steady market growth.

- Corporate buyers are participating in a ‘flight to quality.’

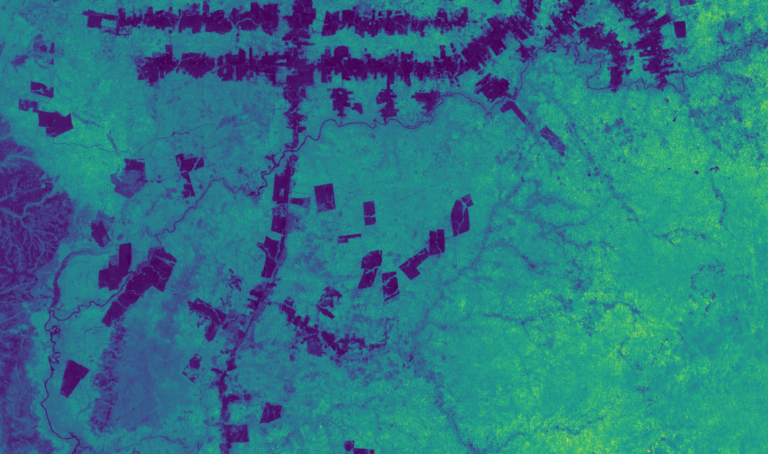

- Technology is working to unlock greater supplies of high-quality projects.

- Corporates are focusing on ‘investing’ over ‘buying’.

- Carbon credits should come ‘last, but not later.’

- Companies are going beyond ‘offsetting.’

- Buyers and developers are pushing for more equitable approaches to carbon project development.

- Standard-setters are working on better, more consistent corporate guidance.

- The voluntary market is laying the foundations for mandatory regulation.

- The voluntary carbon market is still growing.