In 2023, nature became a ‘main character’ in corporate climate action.

There’s a lot happening in the world of carbon markets. Despite — or perhaps because of — intense media scrutiny over nature-based carbon investments, we’ve seen a number of positive shifts in the VCM this year.

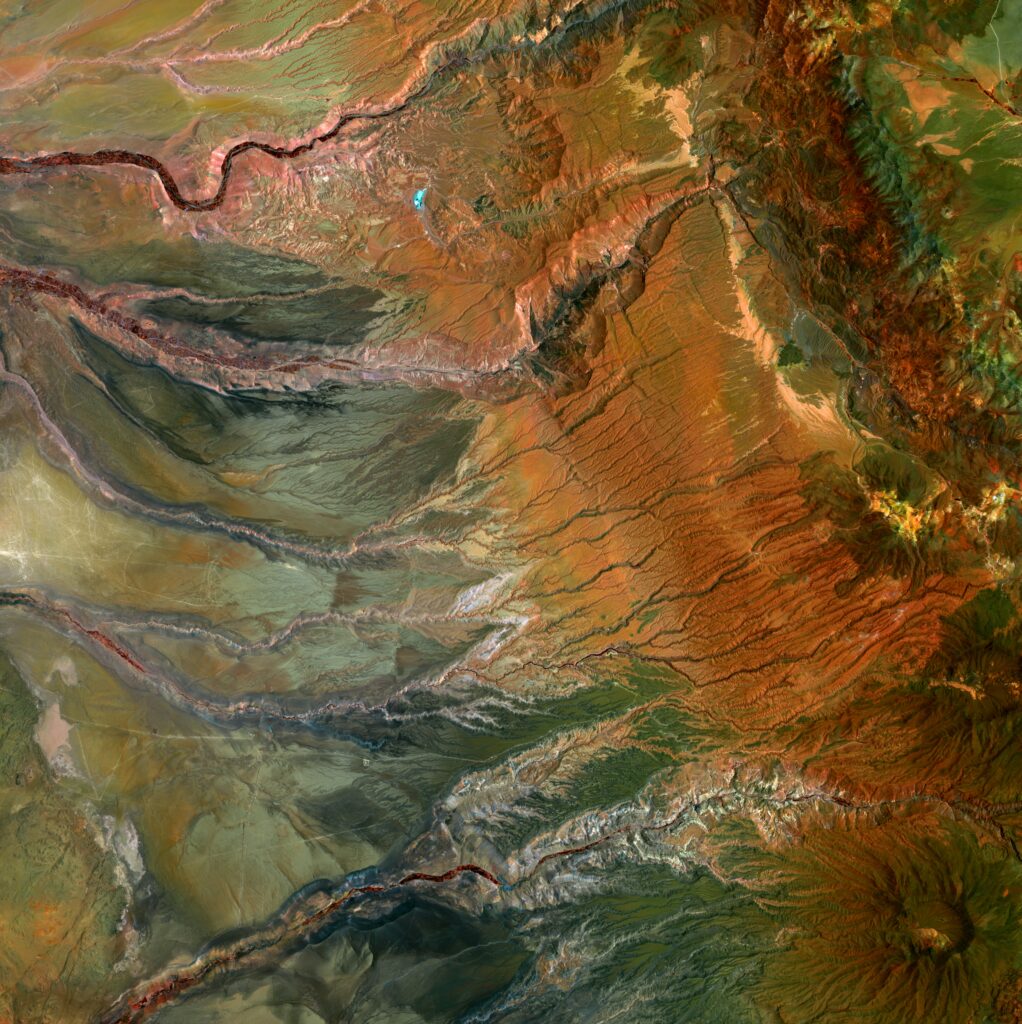

From policy shifts and tech breakthroughs to longer-term nature investments, the evolution of the market reflects increasing recognition of nature’s pivotal role in keeping global warming below 2℃.

Hear from Pachama’s experts on a pivotal year for nature and the carbon market.

Trends to watch

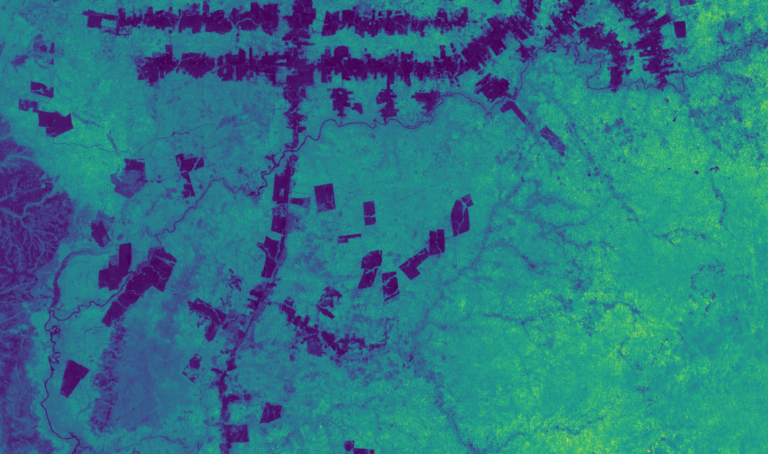

- A buyer’s market for quality conservation credits. While supply of quality ARR credits is limited, REDD+ credits are available. Co-benefit labels are attracting a price premium, a trend we believe is here to stay.

- Corporates continue to seek clarity. A new wave of guidance from leading market bodies will help buyers navigate the VCM, which is finding increasing alignment with regulatory requirements.

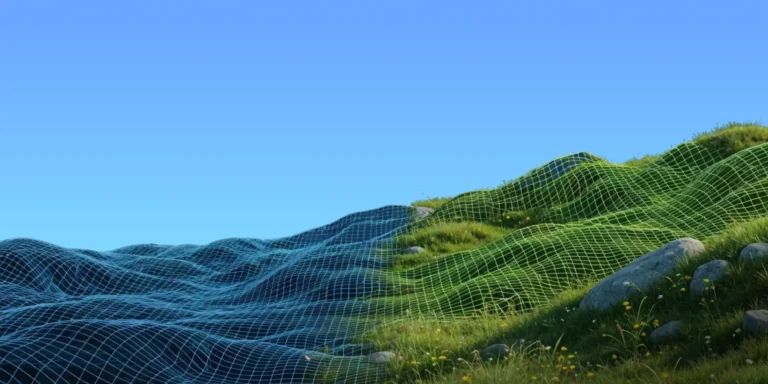

- Nature, backed by tech. The latest IPCC science doubles down on nature as a must-have solution. Meanwhile, breakthroughs in AI-driven carbon mapping will accelerate forest carbon projects.

- Brands are going big on nature with a growing focus on biodiversity. Corporate climate strategies are placing more emphasis on nature and biodiversity — and leading brands are talking proudly about their investments.