BCG is defining a new vision for corporate climate responsibility, leading the way for their clients and peers, both in their efforts to reduce emissions through changes to their operations, and by removing emissions through purchasing high-quality carbon credits.

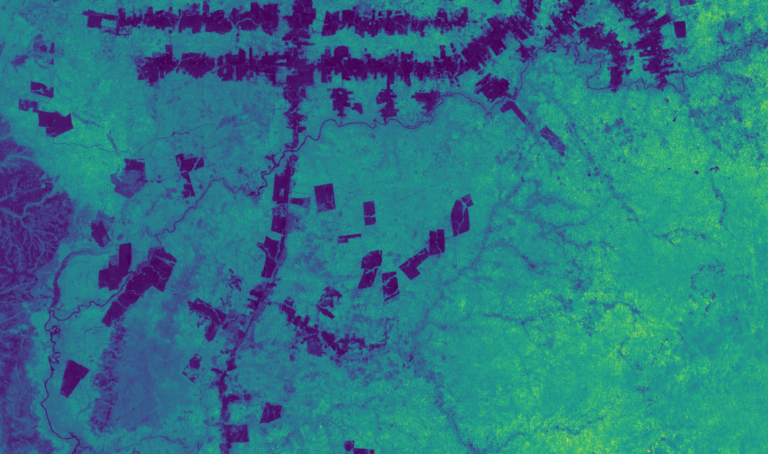

Since 2021, BCG has partnered with Pachama on nature-based carbon projects. Our technology gives BCG transparency and visibility into their projects, helping them better evaluate project quality, invest with confidence, and track carbon and non-carbon impacts over time.

In this case study, you’ll learn how the innovative consulting firm sets targets, balances decarbonization with abatement, and approaches nature-based investments.

How is BCG driving climate action with a leading strategy?

BCG’s climate commitments have been supported and driven by their leadership team, who truly understand the urgency of climate change and want to align the company’s actions with their values. With climate and sustainability consulting becoming a significant part of their business model, the firm is passionate about leading by example for their clients.

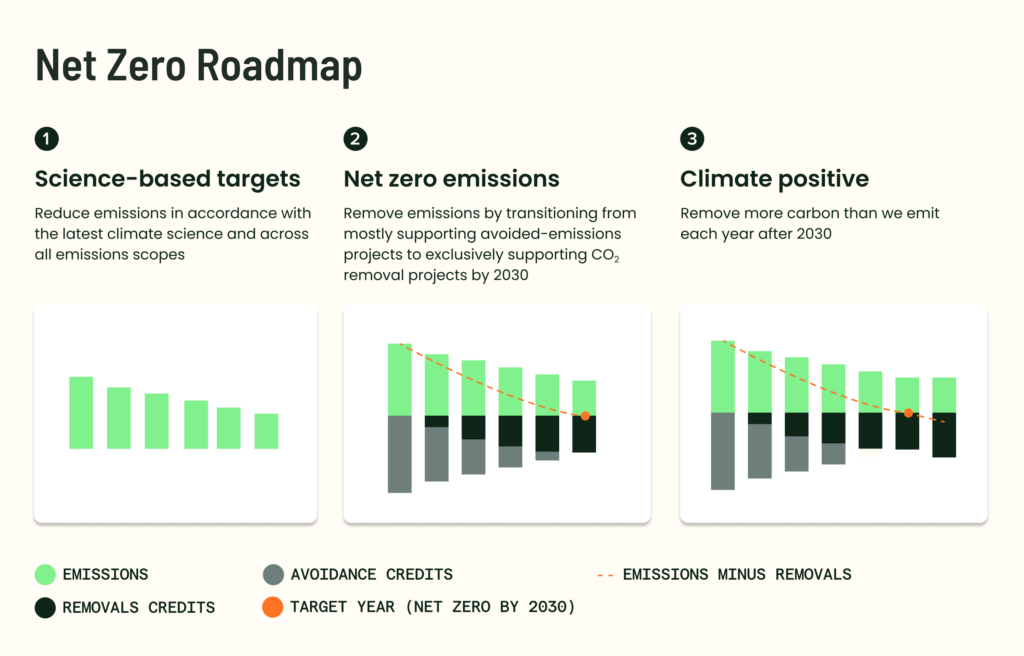

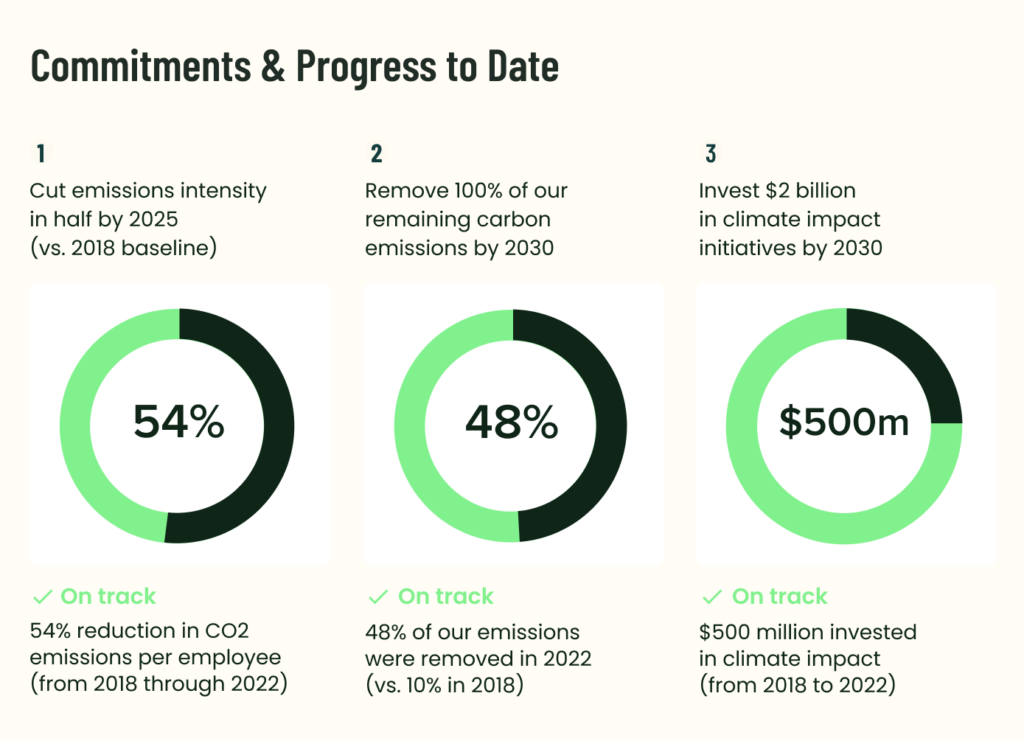

In 2018, the firm began measuring emissions across its portfolio and purchasing carbon credits. The team moved fast; that same year, they achieved Carbon Neutral certification, which they still hold today. In 2020, they scaled up their climate team and committed to more ambitious targets for abatement and decarbonization. The firm set a near-term target to halve its emissions intensity by 2025 (compared to their 2018 baseline) and beyond this to achieve net zero climate impact by 2030 and to become climate-positive thereafter. Their net-zero strategy is built on two key elements: reduction and removal.

Reduction

BCG has committed to cutting its emissions intensity in half by 2025 against a 2018 baseline — a target validated by the Science-Based Targets initiative (SBTi) as aligned with the goal of limiting global warming to 1.5°C. To achieve this, the company focuses on business travel emissions (Scope 3), which is their largest source of emissions, totaling 80% of their baseline, and purchased energy (Scopes 1 and 2). By 2025, the firm aims to cut business travel by 48.5% per employee and shrink energy emissions by 92% per employee, the vast majority of which has already been achieved by transitioning to renewable energy.

Removal

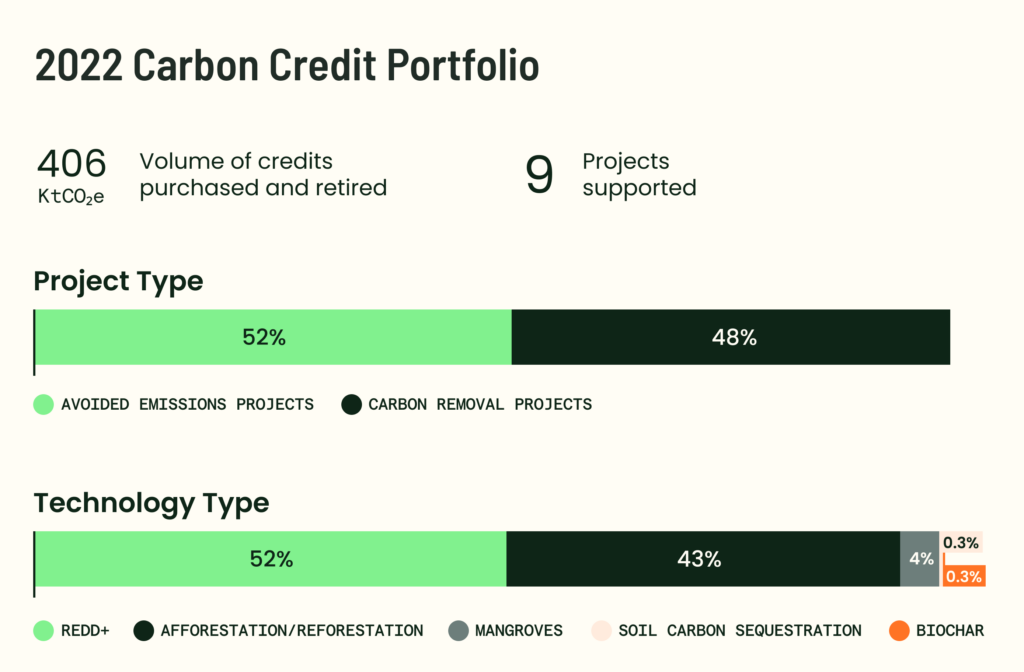

Any emissions that can’t be reduced by 2030 will be removed using the most effective nature-based and engineered carbon removal solutions on the market. Already, the firm makes annual carbon credit purchases to maintain carbon neutrality. Delivering on net zero will require a more diversified portfolio, from REDD+ to reforestation and engineered removals.

Ready to learn more?

Get in touch with our team of experts to learn how we can help you invest in tech-verified projects or start your own project from the ground up.

Carbon pricing

“What’s unique for BCG, is that we have publicly communicated the price we expect to pay per ton to reduce, avoid, and remove our emissions as we work towards net zero.” says Will Holt, Global Sustainability Manager at BCG. This begins at $35 per ton in 2025 and will rise to $80 per ton in 2030. “We have already doubled our blended carbon price from $6 per ton in 2018 to $16 per ton in 2022,” says Holt. “This evolution reflects our commitment to support a mix of projects and scale up high-quality, high-performance removals as we work towards 2030.”

Progress to date

Despite rapidly changing corporate environments, operating models, regulations, and public sentiment, the first three years of BCG’s net zero journey have put them well on track to meet their 2030 commitment. By 2022, they had reduced emissions by 54% per employee (a ~30% total carbon footprint reduction), removed 48% of the year’s remaining emissions, switched their offices to 100% renewable electricity, and invested more than $500 million in climate impact efforts, with a commitment to invest $2B by 2030. BCG’s consulting team has also delivered over 2,000 climate and sustainability impact cases to their clients since 2020.

How does nature fit into BCG’s climate strategy?

In 2020, BCG published a report on the value of forests. The report concluded that existing forestland, which covers approximately 30% of the earth’s surface, holds some $150 trillion in value. As much as 90% of that value comes from forests’ ability to regulate climate, yet we’re losing the equivalent of 30 football fields every minute. “Being able to quantify the value of forests gave us a clear argument for focusing on nature as a solution,” says Bruce Kennedy, Senior Sustainability Manager at BCG.

“Nature is also one of the solutions that can remove carbon right now,” he explains. “It will play a prominent role in the next ten years because that’s where a lot of the carbon can be removed or avoided.” However, BCG doesn’t believe there’s a silver bullet in any climate solution. “We have to utilize all of the levers we can, and that philosophy applies to carbon credits as well,” says Kennedy. This is one of the reasons the company is taking a portfolio approach to carbon investments.

Building a nature portfolio

Knowing that nature would be core to their strategy, BCG partnered with Pachama to source high-quality projects. The team has taken a unique approach to the popular ‘avoidance vs. removals’ question. “We don’t believe we should be just supporting one or the other,” says Kennedy. “There’s no benefit to us putting capital into planting new forests if existing, long-standing forests are not being protected.” They also recognize the challenges REDD+ projects need to overcome, which is why they invest time and resources into identifying and supporting high-quality projects that deliver real climate impact. For example, the company’s participation in the LEAF Coalition demonstrates its support for high-quality REDD and jurisdictional REDD projects.

The team’s portfolio today comprises a mix of avoidance and removal credits, but the plan is to transition to 100% removal credits by 2030. “If we moved to 100% removals tomorrow,” Kennedy explains, “that wouldn’t send the right signal and it would put at risk those avoidance projects delivering real climate impact today.” Holt continues “Equally, we also recognize that the world needs to massively scale up our removal capacity if we’re going to meet 1.5°C, and we believe BCG can play a role in unlocking the potential of breakthrough carbon removal technologies today.” For example, the firm recently announced a new partnership with CarbonCapture Inc. to purchase 40,000 tons of high-quality permanent direct air capture (DAC) credits, building on their existing partnership with Climeworks, another leader in the DAC market.

What is BCG’s perspective on quality and the role of technology?

To ensure a high standard of quality, any credits purchased by BCG must adhere to an ICROA-approved standard and align with the IC-VCM’s core carbon principles. They further enhance this process by adding specific buyer preferences to ensure they purchase credits from projects demonstrating best practices.

“These additional preferences vary among buyers based on their individual objectives,” explains Kennedy. “What constitutes high quality for one user may differ from another’s perspective; for instance, one buyer may prioritize social outcomes, while another is solely focused on environmental benefits.”

With support from the Environmental Defense Fund (EDF), BCG surveyed nearly 500 company leaders, revealing that GHG impact commands the highest willingness to pay for credits. Both robust project transparency and MRV can bolster confidence in GHG impact.

BCG has defined three clear priorities for their carbon credit investments:

- Climate benefit: “We want our credits to have impactful climate benefits,” says Kennedy. “Is the project doing what it’s reporting? Is it really avoiding one ton of carbon being emitted or removing one ton of carbon from the atmosphere?” A clear, measurable climate benefit validated by robust carbon accounting is critical.

- Durability: BCG’s due diligence involves understanding how long carbon will be avoided or removed, and whether it aligns with project timeframes. “One question we’re asking increasingly when it comes to reforestation is: is this project delivering a like-for-like ecosystem to the forest in and around that region?” Kennedy explains. “We consider ecosystems in relation to durability, because native species planted in the style of a local native forest have significantly higher chances of being durable in the face of risks such as pests, wildfires, and climatic conditions.”

- Community impact: “Nature-based projects offer co-benefits beyond carbon reductions and have much higher success rates of delivering if the local communities are engaged with that project and benefit from it. We’re looking for projects that have benefit-sharing and a strong sense of social justice.”

With the current state of the VCM, it can be challenging to find projects that meet all of BCG’s criteria, but technology is making this increasingly easier. BCG is using new data and tools from partners like Pachama and rating agencies to support due diligence, provide unprecedented transparency, and identify high-quality projects. Pachama’s remote sensing-based project insights help improve the speed and depth of BCG’s due diligence processes, and the team finds alignment with Pachama across all three of their quality pillars.

Ready to build your nature strategy?

Get in touch with our team of experts to learn how we can help you invest in tech-verified projects or start your own project from the ground up.

Why is BCG partnering with Pachama?

Deep due diligence and high-quality projects

Advancements in tech have made measurement, reporting, and verification (MRV) much more transparent and rigorous. “That’s where our partnership with Pachama is very useful,” says Kennedy, “particularly for their geospatial data sets and analysis.” MRV developments have given buyers transparency in a historically opaque market. Pachama’s evaluation reports and carbon monitoring, supplement their own data and allow the team to conduct due diligence effectively and thoroughly.

We’re able to utilize Pachama’s tools to see our carbon impact — not just at the point of buying, but on an ongoing basis. We’re able to see how that project is performing, year after year.

Pachama’s Project Evaluation Criteria, which recently underwent an important update, align closely with BCG’s quality pillars. Our ever-growing selection of high-quality projects makes it easier for the team to select the projects that help them maintain carbon neutrality and reach their net zero goals.

Leading the market

Kennedy also acknowledges Pachama’s value in moving the VCM forward at a time when technology, science, and best practices are continually evolving. “It’s really important for us to have a partner that wants to push those advancements forward and help drive the market towards higher standards by utilizing technology and science,” he explains. “That’s what Pachama has been able to do over the last few years,” Kennedy says.

But the VCM doesn’t stand still. “This is such a fast-moving space, says Holt, “and technology and best practices are evolving alongside the need to lock in multi-year projects. We recognize that best practice today may not be best practice tomorrow.”

Both Pachama and BCG encourage corporates not to let ‘perfect’ be the enemy of progress. “We think it’s important to act now in alignment with what we know today, but we also recognize that we’ll need to continue evolving our approach,” says Holt.

For more information on BCG’s net-zero strategy or Climate Change & Sustainability consulting services, please contact BCG’s Global Internal Sustainability Team.