Fine wines and carbon credits share a common feature — vintages or vintage years. While most people understand vintages on wine labels, many buyers don’t know what they mean when it comes to carbon credits.

This article explains everything you need to know about carbon credit vintages and what they mean for your investments.

What are carbon credit vintages?

A carbon credit vintage refers to the time period that the carbon avoidance or removal occurred. Every forest carbon project will have multiple vintages over its lifetime. Projects typically undergo the costly verification process every 3-4 years, although this can vary widely depending on the project type and scale. With each verification, new credits are issued as part of a new vintage.

The verification process is complex and typically takes at least one year, so seemingly older vintages may have actually just been made available for sale. This means carbon credits with older vintages haven’t necessarily been ‘sitting on the shelf’ waiting to be purchased. Projects often have credits available for purchase from multiple vintages at once. Because of market perception, these tend to have different price points. For example, a 2018 vintage might be for sale at the same time as a 2021 vintage but at a lower cost because many buyers are seeking newer vintages.

Two common myths about carbon credit vintages.

Buyers often believe that 1) newer vintages represent higher quality and 2) the vintage year should align with the time of emissions offsetting. Both of these notions are misguided—here’s why.

1. Does vintage year indicate quality?

Contrary to common misconception, vintage year doesn’t indicate quality. Scientifically speaking, past carbon sequestration can have a greater climate impact than more recent carbon sequestration — to keep warming to 1.5°C, timing matters. Yet some buyers seem to believe that carbon credit quality declines over time. If due diligence has been done correctly, this can’t be true. Additionality and permanence markers don’t change over time, and if the credit is of high quality in the first place, it can’t ‘expire’.

Other buyers raise concerns that older carbon credits represent a lower quality bar because registries update and improve their methodologies over time. Many buyers use methodologies as a proxy or ‘screen’ for filtering out high-quality credits and are willing to eliminate certain projects based on the age of the methodology.

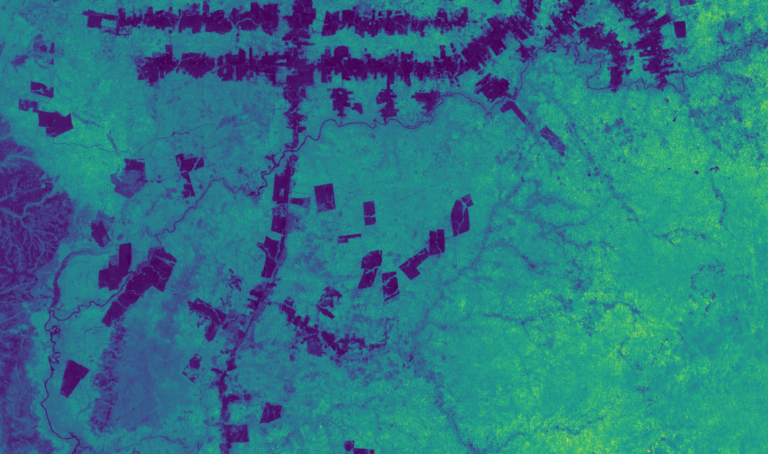

But methodology isn’t the most reliable way to assess credit quality. Pachama evaluates carbon credits on a project-by-project basis and not simply by the methodology. This gives buyers confidence in credit integrity, no matter the age of the methodology or the credit vintage. So long as the project provides essential carbon accounting and project impact data, anyone can evaluate the project quality against today’s market standard. In fact, older vintages can offer greater confidence in durability, because we can validate that the trees are still standing and the project has a proven track record of success.

Ready to learn more?

Get in touch with our team of experts to learn how we can help you invest in tech-verified projects or start your own project from the ground up.

2. Do vintage years and emissions years need to align?

Aligning vintage years with emissions years lacks a scientific basis.

Many projects issue what’s known as ex-post credits, meaning credits are based on the carbon reduction or removal that has already taken place from the growth or conservation of trees. Take, for example, an avoided deforestation project put under protection in 2018. This same forest will continue to produce emissions reductions in 2019, 2020, 2021, and onward for the remainder of the crediting period. Whether it’s a 2023 vintage or a 2019 vintage, you are, in practice, protecting the exact same forest.

The climate does not operate on a “FIFO” accounting method for carbon, therefore the synchronizing of emissions and reductions is not nearly as important as investing in quality projects. And for what it’s worth, neither the ICVCM’s Core Carbon Principles nor the VCMI’s Claims Code list vintage requirements as denoting carbon credit quality.

Why buyers should consider older carbon credit vintages.

Savvy buyers may be attracted to the lower price points of older vintages. With so many buyers investing in recent vintages (in the last five years), carbon credits with older vintages are often less expensive. This allows climate budgets to go further (without compromising on quality). Since the vintage year is not a reliable proxy for credit quality, buyers who write off older vintages risk compromising either on quality or budgets.

But there’s another, perhaps more important, reason to consider older vintages. Often, projects will go into debt to cover the cost of verification, expecting future sales to help them repay this debt and continue to fund project activities. Without selling these older vintages, the project’s future activities may be at risk (a big problem for permanence). Project developers often take risks by selling credits in this speculative manner, which is something buyers on the hunt for ‘newer’ vintages may not appreciate. Buying older vintages can help keep critical carbon projects stay afloat and ensure they continue to have a positive climate impact.

How to evaluate vintages when you’re investing in carbon credits.

When considering older vintages, it’s important to ensure the project meets key quality indicators and that there is enough evidence to support its claims. Any vintage you buy must equal at least one ton of CO2 removed or avoided. New technology and remote sensing can help validate credit quality with greater accuracy and provide the data you need to defend investment decisions and back up claims.

Pachama’s Project Evaluation Criteria has four core quality standards. Projects must be:

- Additional: emissions reductions would not have occurred without the incentive of carbon credits.

- Conservative: emissions reductions are robustly quantified, and each credit represents at least one metric ton of carbon.

- Durable: the project delivers a long-lasting climate benefit ensured by continuous monitoring and public reporting.

- Beyond Carbon: the project causes no net harm and delivers biodiversity and community benefits.

Due diligence must go beyond vintage year.

While vintage year is a consideration, due diligence for carbon credit investments must extend beyond it. Quality and rigor matter more than vintage year.

Ultimately, carbon credits are a commodity. Their quality can’t expire or decline over time, and they don’t come with a ‘best before’ date. What matters is the quality and rigor of the project. Pachama offers tools and data to ensure that the volume of credits a project issues is defensible, and that they have the impact they claim to.

Ready to build your nature strategy?

Get in touch with our team for support on your carbon credit investment journey.