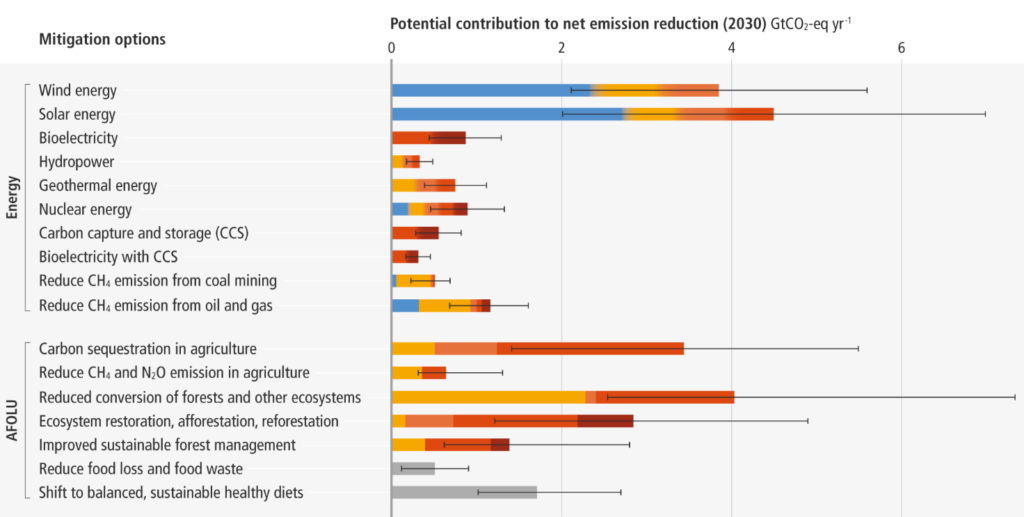

This year’s IPCC’s recent AR6 Synthesis Report caught our attention.

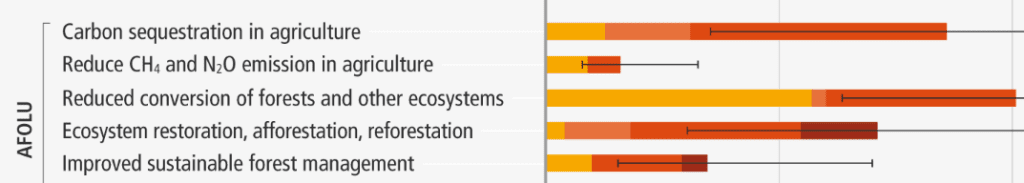

According to the IPCC Report, of all the solutions available today to reduce net emissions by 2030, “reduced conversion of forests and other ecosystems” ranks second only to solar energy.

Combined with ecosystem restoration, afforestation, reforestation, and improved sustainable forest management, forest carbon can potentially remove almost eight gigatons of carbon dioxide per year (GtCO2-eq) from the atmosphere.

At Pachama, we find this insight encouraging. According to the United States Environmental Protection Agency, land use change is the second leading source of carbon emissions after fossil fuels. With proper management, we can reverse the trend and convert forests into our most powerful carbon removal technology.

However, there is a catch: to achieve planetary stabilization through forest carbon activities, we must correctly price forest carbon credits to incentivize conservation and reforestation as competitive land uses.

Specifically, according to the same IPCC report, carbon credits must be priced between $50 and $200 per ton for forest carbon activities to achieve their environmental potential. To address climate change at the speed and scale necessary, the price of reforestation carbon credits must significantly increase and more closely align with the IPCC’s recommendations.

What factors influence forest carbon credit cost?

Determining how much a carbon credit should cost is a complex question whose answer has significant ripple effects on the economy and the planet. If prices for forest carbon credits are too low, project developers looking to bring new high-quality forest carbon projects to market will struggle to compete with other land uses, like agricultural or commercial development.

On the other hand, if prices for forest carbon credits are too high, their impact may become more limited. Without a suitable price point, many corporates will opt out of purchasing reforestation credits, and these critical projects won’t get the funding they need to get off the ground. The right price point for carbon credits incentivizes high-quality carbon removal worldwide.

To understand the true cost of removing an equivalent metric ton of carbon dioxide from the atmosphere, Pachama sourced data from projects across the Americas. To inform our analysis, we gathered data across hundreds of projects from project developers primarily concentrated in North and South America. With data in hand, we were able to develop an understanding of what costs project developers incur and what percentage of the overall project budget each represents.

While many factors influence the cost required to produce a high-quality carbon credit from an active reforestation project, we found that two of the most influential factors are: (1) credit yield, or the carbon dioxide sequestered annually by the newly planted vegetation, and (2) the form of land ownership. Fluctuations in these two factors drive a wide range in costs.

Pachama’s analysis: why upcoming 2023 vintages should cost between $50 and $82 per credit

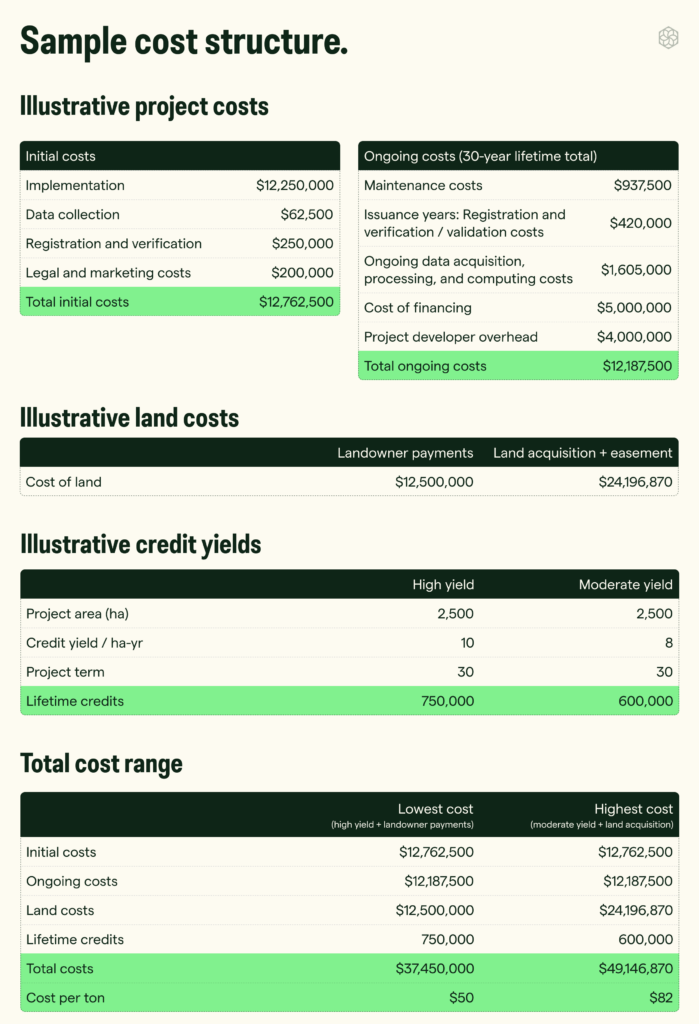

In our analysis, we further broke down the costs of producing high-quality reforestation credits into three key categories:

Landowner relationship: The cost of purchasing land or paying landowners for land use may vary between geographies and depend on the potential credit yield, which in turn depends on factors such as forest type and tree survival rate. Either purchased land or repurposed land may also have to acquire a permanent easement to ensure the long-term durability of the project.

Initial costs: Across geographies, project developers must invest in initial costs such as tree planting (purchasing quality seedlings from nurseries and planting the trees), data acquisition, registration, verification, and legal and marketing costs.

Ongoing costs: Over the lifetime of a project, developers also have to maintain the project to mitigate risks, optimize tree survival rates, and pay for periodic verification. Most generated high-quality carbon credits include the following ongoing cost categories:

- Technology costs: Includes LiDAR data, field plots, cloud computing costs, etc., required to build higher precision forest growth and sequestration models.

- Financing costs: Project developers may seek third-party financing because of the high upfront costs for land and/or implementation. These financiers often require a return on investment in the high single digits to low teens.

- Project developer overhead: Includes shared overhead costs required to pay project development staff and market projects. Project developer costs may vary, considering that some forest carbon projects are undertaken by non-profits or public-benefit corporations and others by for-profit entities.

Based on our findings, we’ve developed a sample cost structure for a 2,500-hectare active reforestation project.

The upfront land costs are significant in our sample cost structure model for an active reforestation project, representing 33% – 49% of the total lifetime cost. Combined with the initial costs required to initiate tree planting and qualify for registry issuance, the first five years of a project incur 67%– 75% of the project’s lifetime cost, yet issuance and revenue only activate after the first issuance event, which can occur 5-7 years after tree planting.

Geography also plays an influential role in pricing. It not only affects the cost of land acquisition and labor, but also plays a role in tree survival rates and future credit yields. In addition, different types of forests that are found in different altitudes and climates also generate different credit yields. Moreover, certain jurisdictions may require landowners to conserve a certain percentage of their land as natural forest, thus affecting the project’s overall additionality calculation.

Based on this bottom-up analysis of more than 150 project developer business plans across multiple geographies, Pachama believes the average price for an active reforestation carbon credit from upcoming 2023 vintages should be between $50 and $82 tCO2e.

Why is now the time to invest?

With this data in hand, the IPCC’s cited price range of between $100-$200 tCO2e for forest carbon activities makes sense if we are to scale from the planet’s current capacity of 2.4 gigatons of carbon dioxide removal through forests to well over eight gigatons. Moreover, Pachama’s predicted price range of $50-$82 represents a bargain for those clients considering long-term procurement of credits as part of their net-zero strategy.

A higher price for forest carbon credits creates economic incentives by allowing forest carbon activities to compete with subsidized agriculture and makes the space more attractive to investors willing to help project developers cover their initial costs. It goes without saying that more investors entering the space results in more competitive financial conditions, a win-win that can provide a major boost for the industry and for the planet.

Of course, price alone will not make forest carbon a thriving industry, as price must also reflect the integrity, openness, transparency, and durability of forest carbon projects.

The best way for leading companies to restore nature at scale is to support the creation of new high-quality projects, and consider innovative financial models, such as investing in Pachama Originals, to help put the wheels in motion. The time to act is now. The time to invest is now.

Ready to invest in high-quality reforestation projects?

Learn more about how Pachama can help you invest in tech-verified projects or start your own project from the ground up.