“If we’re going to have a 1.5-degree, just, and sustainable future, nature will play a critical role,” says Erik Hansen, Chief Sustainability Officer at Workday, a leading provider of enterprise cloud applications for finance and human resources and a Pachama customer. “As a company with the opportunity to make catalytic investments in nature, we’re not only benefiting from nature but also from all of the co-benefits that go along with it.”

At Bloom 2023, we spoke to Hansen about Workday’s sustainability commitments and how their team is building a high-integrity nature portfolio.

Workday’s climate commitments

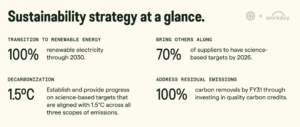

Throughout its sustainability journey, Workday has prioritized transparency. From avoiding carbon-intensive activities, investing in high-quality carbon credits, and mitigating historical emissions to partnering with peers to accelerate the development of permanent carbon removal technologies, Workday has continued to evolve its strategy and share learnings to ensure it’s making the greatest impact.

In the past few years, Workday has dramatically scaled its climate action. In 2020, it achieved net-zero carbon emissions across its offices, data centers, and business travel. In 2021, it announced its participation as a founding member of the Business Alliance to Scale Climate Solutions (BASCS), an organization working to drive corporate climate funding to meet the goals of the Paris Agreement.

In 2022, the company announced its science-based targets. These targets are aligned with 1.5°C across all three scopes of emissions—the most ambitious designation available through the SBTi process at that time.

And in 2023, Workday announced its membership with Frontier, an advance market commitment accelerating the development of carbon removal technologies.

Ready to learn more?

Get in touch with our team of experts to learn how we can help you invest in tech-verified projects or start your own project from the ground up.

How Workday is building a long-term carbon portfolio with nature at the center

Earlier this year, Workday joined ‘Wave 2’ of Frontier, an advance market commitment for engineered carbon removal, and the team plans to take a balanced portfolio approach to carbon credits. “Engineered carbon removal is not going to solve what we need to reach net zero by 2050,” explains Hansen. Experts say we will need to remove up to 10 GtCO2 annually by 2050, but we may not be able to capture all of this through engineered or nature-based removals alone. “We see a portfolio approach needing to emerge there,” Hansen explains. And nature can provide roughly a third of the climate mitigation efforts required by 2030.

“Along with nature-based solutions comes the wealth of co-benefits that we’re really excited about,” says Hansen. “Everything from biodiversity to resilience — mangroves, for example, can help with flooding, storm resistance from hurricanes, all the way through to economic development for local communities. These co-benefits aren’t always as clear on the engineered side.”

A multi-year removals portfolio

To date, Workday’s purchases have been annual and comprised of a diverse portfolio of project types like household devices, fuel switching, and nature-based solutions.

Their nature-based portfolio currently includes avoided deforestation projects and removals projects like ARR and IFM — specifically, mangrove reforestation. They aim to work with partners focused on catalyzing and scaling high-quality nature-based removals projects.

The Workday team is moving toward building a multi-year portfolio that transitions into 100% removals credits, both on the nature side and the engineered side.

Why multi-year?

The team sees multi-year, long-term offtake agreements as critical to providing a demand signal for high-integrity projects currently in short supply. In addition, these agreements help channel the carbon finance needed upfront for truly additional removals — particularly with the higher-cost engineered removals that need to become affordable for all.

Additionally, multi-year deal structures give Workday price and volume security for high-quality credits. This predictability is critical in a market where demand is forecasted to outpace supply, particularly for removals.

Workday’s approach to carbon credit quality

“When you’re talking about voluntary carbon markets, you first and foremost have to think about quality and integrity,” says Hansen. “We’re a really values-driven organization — we wouldn’t be doing the work we’re doing on climate otherwise.” Workday’s core values include both integrity and innovation, which help guide the way that they think about credit quality.

Workday’s sustainability team evaluates carbon credit investments across five key quality criteria:

- Additionality: Emission reductions beyond business as usual.

- Leakage prevention: Preventing shifting of emissions to other locations.

- Permanence: Permanent and long-lasting reductions—not temporary.

- Verifiability: Rigorous independent third-party verification.

- Social impact: Sustainable development, including local workforce development and health and wellbeing benefits for the local community.

As a founding member of the Business Alliance to Scale Climate Solutions (BASCS), they see the BASCS Primer – Corporate Process for Purchasing Carbon Credits as a helpful guide for understanding quality. They also leverage Pachama’s Project Evaluation Criteria for forest carbon projects and encourage potential carbon removal buyers to review Carbon Direct and Microsoft’s Criteria for High-Quality Carbon Dioxide Removal.

Ready to build your nature strategy?

Get in touch with our team of experts to learn how we can help you invest in tech-verified projects or start your own project from the ground up.

Why Pachama?

Workday has been partnering with Pachama to procure high-integrity carbon credits since 2021. These purchases typically happen annually and have included Borneo Peatlands, Pacajá Pará, Manoa, and Chocó-Darién Bioregion. They continue to work with Pachama for a number of reasons, including technology innovation and deep due diligence.

Integrity and innovation

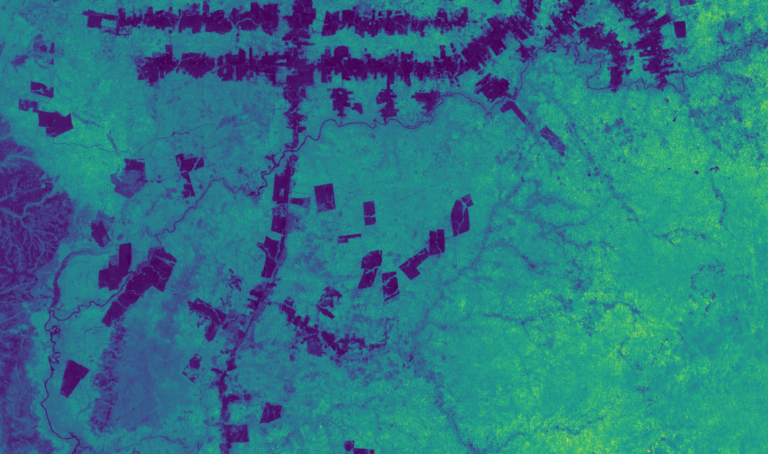

Hansen recognizes Pachama’s value in pushing the market forward with the latest technology and high-integrity projects. “I’m excited by the work Pachama is doing to address challenges in the voluntary carbon market,” says Hansen. “Specifically Pachama’s focus on integrity and innovation. With technology like AI and remote sensing, you can de-risk investments in nature-based projects by setting more accurate baselines, monitoring for leakage, and ensuring permanence,” Hansen explains.

Deep due diligence

To support the needs of Workday’s sustainability team, it relies on expertise in key areas from trusted partners like Pachama. “I think we’re at this interesting time in the voluntary carbon markets right now,” he says. “There are a lot of players who are really focused on trust and integrity and quality that weren’t there a decade ago. In some parts of the market, it was more of a ‘race to the bottom’ going on, and that’s changing. I’m really excited about this intense focus on quality and integrity.”

According to Hansen, being able to rely on Pachama’s best-in-class technological approach to evaluating the integrity and quality of their forest carbon projects helps to speed up due diligence.

De-risking investments

Not only does Pachama’s make due diligence more efficient but simultaneously de-risks carbon credit procurement. “Corporates are facing increasing scrutiny from stakeholders around the quality of carbon credits,” says Hansen. “The additional layer of diligence using AI and remote sensing technology to ensure the integrity and durability of forest carbon projects, that’s the value Pachama brings.”